sales tax rate tucson az 85713

Tumacacori AZ Sales Tax Rate. The 2018 United States Supreme Court decision in South Dakota v.

The Facts About Real Estate Tax In Arizona

Zip code 85713 is located in Tucson Arizona and has a.

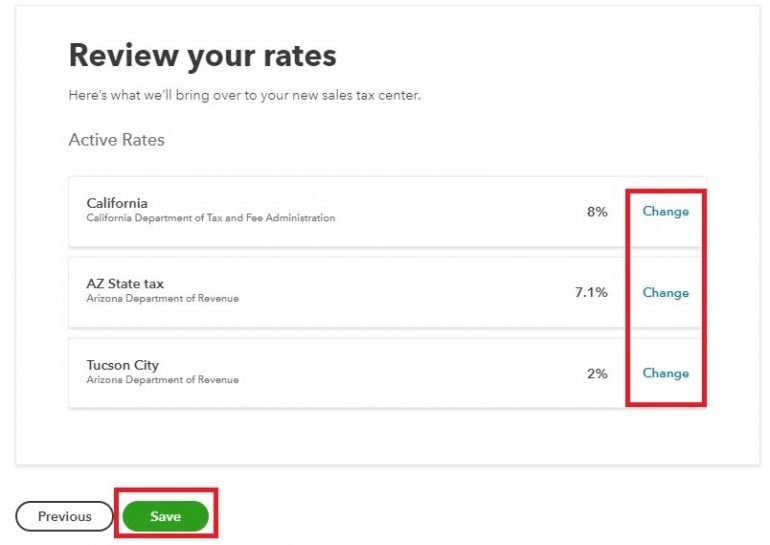

. Arizona Department of Revenue -. The Arizona sales tax rate is currently 56. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250.

For more details please. The minimum combined 2022 sales tax rate for Tucson Arizona is 87. The one with the highest sales tax rate is 85713 and the one with the lowest sales tax rate is 85321.

The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. This includes the rates on the state county city and special levels. Use the physical address or the zip code.

The Arizona sales tax rate is currently. There is no applicable special tax. Has impacted many state nexus laws and sales tax collection.

Sales Tax Transaction Privilege Tax Sales Tax Rate for. Tucson Estates AZ Sales Tax Rate. The most populous zip code in Pima County Arizona is 85706.

Groceries and prescription drugs are exempt from the Arizona sales tax. The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817. Tucson AZ Sales Tax Rate.

4 beds 2 baths 1780 sq. The estimated 2022 sales tax rate for 85713 is. 2 beds 1 bath 768 sq.

The City of South Tucson primary property tax rate for Fiscal Year 2017-2018 was adopted by Mayor Council at 02487 per hundred dollar valuation. The estimated 2022 sales tax rate for zip code 85713 is 870. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county.

1820 S Winmor Ave Tucson AZ 85713 213000 MLS 22213901 Fantastic 2 bedroom home in sought after Tucson AZ location. The sales tax jurisdiction. Tucson AZ 85713.

2180 S Triangle X Ln Tucson AZ 85713 474900 MLS 22223260 Please ask about rate buydown and concessions from the seller. Arizona Tax Rate Look Up Resource. Tubac AZ Sales Tax Rate.

This resource can be used to find the transaction privilege tax rates for any location within the State of Arizona. The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. This is the total of state county and city sales tax rates.

How To Run A Quickbooks Sales Tax Report Nerdwallet

Is Food Taxable In Arizona Taxjar

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia

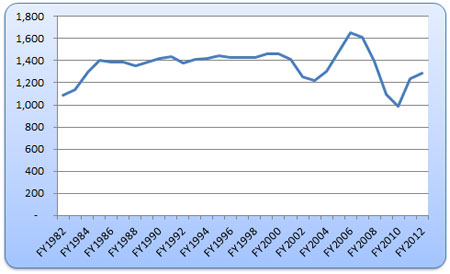

Arizona General Fund Tax Revenues An Historical Perspective Arizona S Economy

Tucson Arizona Az Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Key Arizona Lawmakers Consider Taxing Online Sales Cutting Taxes Elsewhere

5 Things You Need To Know About Sales Taxes In Quickbooks Online Virjee Consulting Pllc

Arizona S 30 Largest Cities And Towns Ranked For Local Taxes Kiplinger

Combining Sales Tax Rates Experts In Quickbooks Consulting Quickbooks Training By Accountants

Pima County Property Tax Due October 1 And March 1

Arizona State Taxes 2021 Income And Sales Tax Rates Bankrate

Tucson Arizona Az Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

2148 E Vera Cruz Vis Tucson Az 85713 Mls 22201738 Zillow

Arizona S Combined Sales Tax Rate Is Second Highest In The Nation Cronkite News

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog